Key Findings

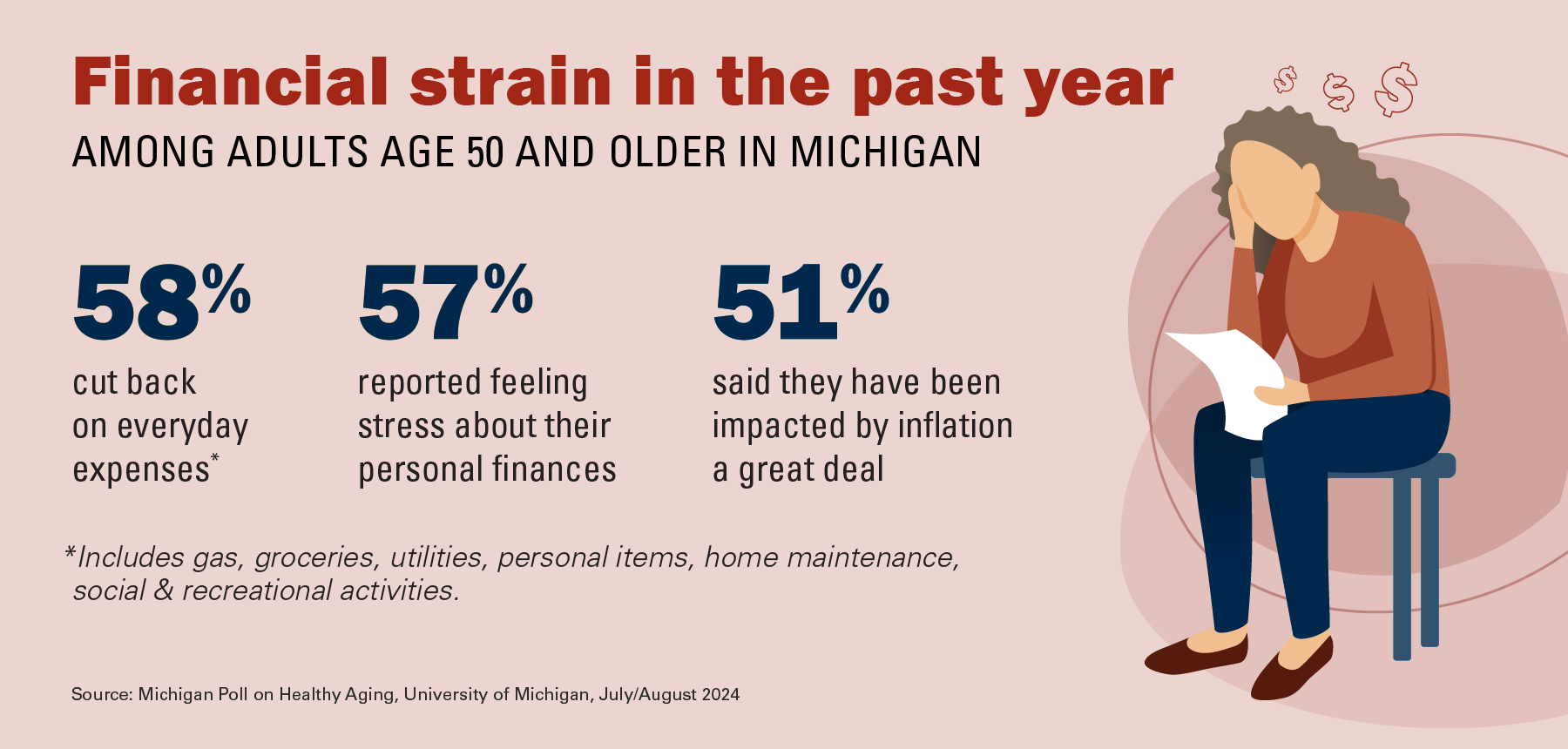

51% of adults age 50 and older reported that inflation has impacted them a great deal in the past year.

In all, 57% of older adults felt stress about their personal finances in the past year (21% a lot, 36% some).

In the past year, 58% of older adults reported cutting back on at least one everyday expense (43% cut back on social and recreational activities, 38% on personal items, 33% on groceries, 27% on home maintenance, 24% on gas, and 14% on utilities).

Michigan’s economy has largely recovered from the pandemic’s sharp downturn, but many Michiganders age 50 and older still say they’re feeling financially stressed or have had to cut back on spending, according to new findings from the Michigan Poll on Healthy Aging.

In the past year, 58% of older Michiganders say they’ve cut back on spending, 51% say they’ve been impacted by inflation a great deal, 57% say they have felt some or a lot of stress about their personal finances, and 15% say they’ve avoided or delayed spending on health care or health-related costs.

Some groups of older Michiganders had much higher rates of these indicators of financial strain, including those in their 50s and early 60s, and those who call their physical or mental health fair or poor.

The poll, based at the University of Michigan Institute for Healthcare Policy and Innovation, is supported by the Michigan Health Endowment Fund and Michigan Medicine, U-M’s academic medical center. It’s conducted by the same team that conducts the National Poll on Healthy Aging, which has just released a companion report on the financial health of people age 50 and older nationwide. The national poll is supported by AARP and Michigan Medicine.

“Michigan’s unemployment rate is now just under 4 percent, the same as the national average,” says Helen Levy, Ph.D., a health economist at U-M who worked with the poll team on the new findings. “But that doesn’t mean that everyone is doing well across the board.”

For an interactive data dashboard that gives full access to Michigan-specific data from the poll, visit https://michmed.org/93MDP.

Comparing Michigan to the rest of the U.S.

In some ways, older Michiganders are more likely than other older Americans to say they’re under financial pressure.

For instance, 52% of people age 50 and older outside Michigan said they have cut back on spending, and 16% say they have felt a lot of stress about their finances, compared with 58% and 21% in Michigan.

And 35% of older Michiganders said they rarely or never have money left at the end of the month, compared with 25% of non-Michiganders.

But when it comes to health-related costs, there was no difference. In all, 15% of Michiganders age 50 and older said they had had trouble paying for, or had delayed, health costs in the past year, about the same as the 16% of people in the same age group who said the same in the rest of the country.

Michiganders were about as likely as people in the rest of the country to say that they or someone they live with had taken steps to increase income in the past year, for instance by working more hours or getting a new or second job, selling items, or taking money out of savings or retirement account. In all, 43% said they had done one of these things.

Differences within the state

Among Michiganders, the poll team found differences in reported spending cutbacks and financial stress.

The groups most likely to say they had cut back on spending in the past year were Michiganders who report being in fair or poor physical health, 77% of whom said they’ve cut back, and those in fair or poor mental health, with 82% saying they’ve cut back.

Michiganders aged 50 to 64 are much more likely than Michiganders over 65 to say they’ve cut back on spending in the past year, at 69% vs. 45%.

Also, 67% of Michiganders with household incomes under $60,000 said they’d had to cut back, compared with 47% of those with higher incomes.

Asked about finance-related stress, 31% of Michiganders in their 50s and early 60s said they have felt a lot of it, compared with 11% of those 65 and over.

And 55% of Michiganders who said their mental health was fair or poor said they had felt a lot of financial stress, compared with 17% of those with better mental health. The difference was 37% vs 18% for Michiganders with fair/poor physical health vs better physical health. Also, 28% of Michiganders with incomes below $60,000 said they experienced a lot of financial stress, compared with 13% of those with higher incomes.

Among Michiganders who reported being caregivers, 14% said they have felt a lot of stress related their personal costs of providing care in the past year. But this rate was higher among caregivers age 50 to 64 (17%) compared with 10% of those over 65, and for those caregivers who reported being in fair or poor physical health themselves (29% vs 12%).

Regional differences emerged within the state. For instance, the percentage who said they or someone they live with had taken financial steps to increase income in the past year was higher in the southwestern part of the state (53%) and northern Michigan (50%). This compared with the southeast (36%) and central (46%) portions of the state.

There were also differences within Michigan when it came to spending money on health costs such as going to a doctor, getting a prescription, or having their teeth or eyes checked.

Most strikingly, 26% of Michiganders in fair or poor physical health, and 28% of Michiganders in fair or poor mental health, said they had cut back on or delayed health-related spending, or didn’t get needed care, compared with 12% and 13% of Michiganders who said their physical or mental health was good, very good or excellent.

And 19% of Michiganders with incomes under $60K said they had delayed or avoided health costs, compared with 10% of those with higher annual household incomes.

“Our state’s least-healthy older adults are also those most likely to cut back on expenses that relate to their health, which can have long-term consequences and even accelerate complications from chronic conditions like diabetes or high blood pressure,” says Jeffrey Kullgren, M.D., M.P.H., M.S., who directs both the national and Michigan polls. He is a health care researcher and U-M Medical School faculty member who has studied the impact of cost-related behaviors on individual health, and provides care within the VA Ann Arbor Healthcare System.

Ways to get or give help

If someone is feeling financially stressed — especially if they have a low income, disability, caregiving responsibilities, or are over 65 — they should check out what local, state and federal programs they might qualify for, Kullgren said.

Websites such as www.benefits.gov, eldercare.acl.gov and Michigan’s newmibridges.michigan.gov are good places to start. Or call the United Way’s 211 service or visit its site at www.211.org.

For those with time and ability to help others, many non-profit organizations post volunteer opportunities through the United Way.

About the poll

The poll report is based on findings from a representative survey conducted by NORC at the University of Chicago for IHPI and administered online and via phone in February and March 2024 among 1,079 Michiganders over age 50 (367 of whom were from the national sample); the national sample included 3,012 non-Michiganders. The sample was subsequently weighted to reflect the state and U.S. population.

Learn about other findings from the Michigan Poll on Healthy Aging, read past National Poll on Healthy Aging reports and read about the poll methodology.

Anyone interested in receiving Michigan and national poll reports and other updates may sign up for the email list at https://www.healthyagingpoll.org/email-sign-up.