Key Findings

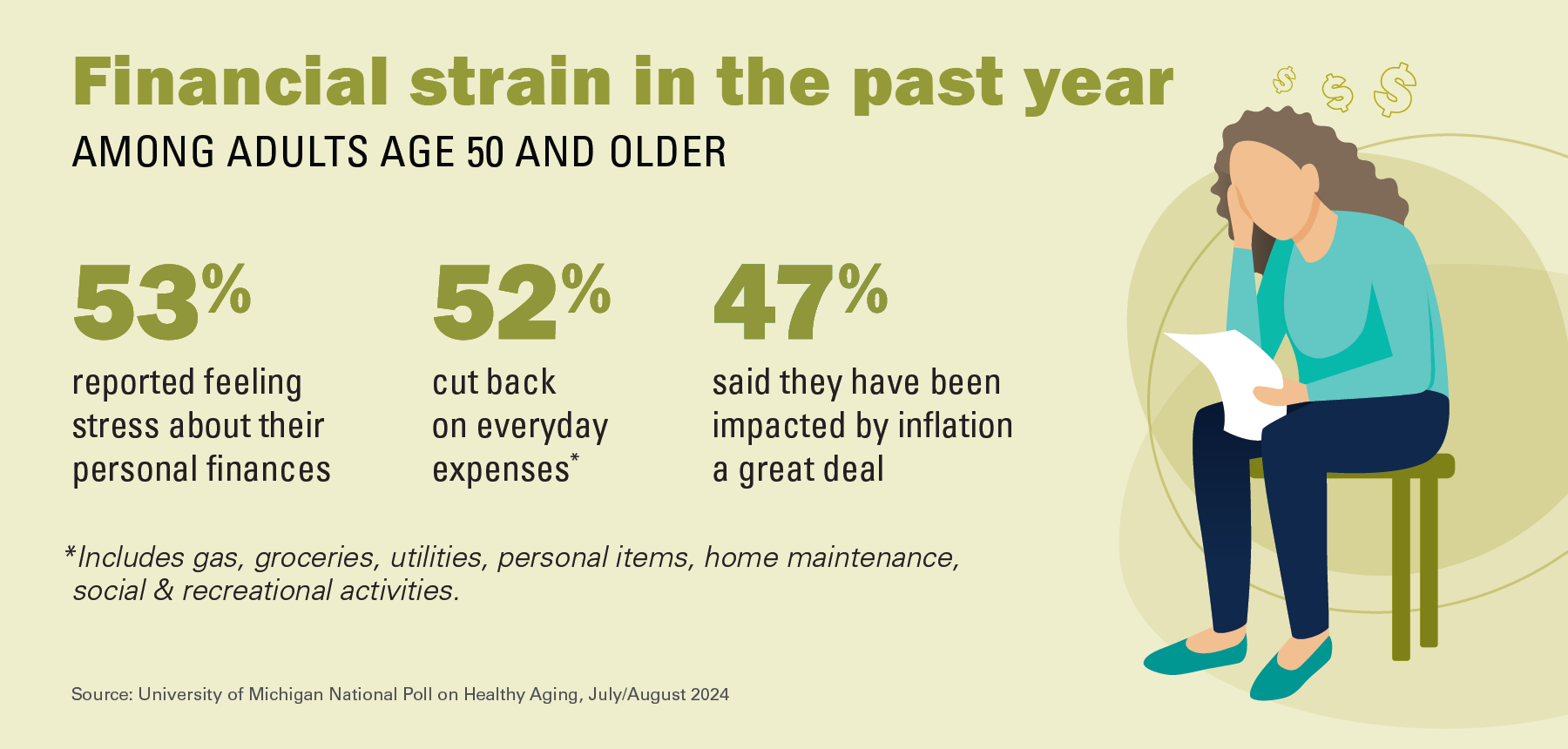

47% of adults age 50 and older reported inflation has impacted them a great deal in the past year.

53% of older adults felt stress about their personal finances in the past year (16% a lot, 37% some).

In the past year, 52% of older adults reported cutting back on at least one everyday expense (38% cut back on social and recreational activities, 30% on personal items 28% on groceries, 27% on home maintenance, 15% on gas, and 13% on utilities).

Many people experience financial challenges as they grow older, especially those living on fixed incomes. Inflation can further strain financial security, creating even greater challenges to health and well-being. In February and March 2024, the University of Michigan National Poll on Healthy Aging asked a national sample of adults age 50 and older about their financial well-being and actions they were taking to make ends meet.

Financial well-being

In all, 33% of adults age 50 and older said that the statement “I am concerned that the money I have or will save won’t last as long as I need it to” described them or their situation completely or very well in the past year, and another 32% said it somewhat described them. Overall, 25% of older adults said the phrase “I am just getting by financially” described them completely or very well in the past year, and 30% said it somewhat described them. A similar proportion (26%) said that in the past year they rarely or never have money left over at the end of the month.

Most adults age 50 and older (88%) said inflation has impacted them in the past year, with 47% stating it has impacted them a great deal. Those more likely to say that inflation has impacted them a great deal were age 50–64, with less education (some college or less), in lower income households (annual household income less than $60,000), or with fair or poor self-reported physical or mental health.

Strategies for making ends meet

About half of older adults (52%) reported cutting back on at least one everyday expense in the past year. Among all adults age 50 and older, 38% cut back on social and recreational activities, 30% on personal items (e.g., clothing and toiletries), 28% on groceries, 27% on home maintenance, 15% on gas, and 13% on utilities. A greater percentage of those age 50–64 (58%) reported cutting back on everyday expenses in the past year compared with those age 65 and older (45%), as did Hispanic (60%) and Black respondents (58%) compared with White respondents (51%). Women, people with fair or poor physical or mental health, and individuals in lower-income households were also more likely to have said they cut back on at least one of these expenses in the past year.

Overall, 16% of adults age 50 and older said that in the past year they had trouble paying for health insurance, prescription drugs, or health care services, or that they delayed getting or did not get needed health care. Those in fair or poor mental health were more likely than those in excellent, very good, or good mental health (35% vs. 14%) to have had trouble with the costs of health care. The same was true for those reporting fair or poor physical health compared with those with better physical health (29% vs. 13%).

More than half of older adults (58%) took at least one action in the past year to reduce expenses or make money available for other purposes. Overall, 47% cut back on discretionary spending, 29% cut back on savings, 19% used credit cards without paying the monthly balance, 15% cut back on necessities, 10% borrowed money from family or friends, and 7% took out new loans or refinanced their home.

To increase income in the past year, some adults age 50 and older said they or someone in their household had taken money out of savings or retirement (26%), sold items/possessions (16%), worked more hours (15%), or gotten a new or second job (7%).

Stress related to personal finances

Over half of older adults (53%) said they felt stress related to their personal finances in the past year (16% a lot, 37% some). Those in fair or poor mental health were more likely than those with better mental health to report a lot of stress with finances (46% vs 13%), as were those in fair or poor physical health compared with those in better physical health (37% vs. 11%). In addition, women, people age 50–64, and individuals in lower-income households were more likely to have felt a lot of stress with personal finances in the past year than men, those age 65 and older, and people with higher annual household incomes, respectively.

Among older adults who identified as a caregiver, 14% reported feeling a lot of stress, 27% reported some stress, and 25% reported feeling a little stress related to the financial and personal costs of their caregiving responsibilities in the past year.

Implications

This poll found that the majority of adults age 50 and older are taking steps to reduce their spending. The expenses older adults cut back on are a function of where they are on the economic ladder with those with lower incomes more likely to make cuts that may more directly impact their health. For example, delaying or foregoing medical care might have negative consequences for health and well-being; cutting back on groceries may have adverse effects on nutrition; and limiting social and recreational activities could limit social connections and contribute to loneliness.

There are demographic differences in experiences of financial strain. Notably, across measures of financial well-being, those age 50–64 appear to be experiencing more challenges than those 65 and older, even though the latter are more likely to be living on a fixed income. Experiencing financial strain before age 65 can result in greater challenges over time as incomes tend to decline with retirement. In addition, women and those in lower income households were more likely to report financial strain. Moreover, those with fair or poor physical or mental health were also more likely to experience financial strain which could further exacerbate their health issues.

Even with careful planning, many people age 50 and older experience financial strain. Health problems can further challenge people’s financial status, and financial strain can contribute to poorer health. It is important to recognize and support older adults who are experiencing financial challenges and provide education and opportunities to reduce their risk for adverse financial, health, and other outcomes. Policymakers, clinicians, and social service organizations should be aware of the financial vulnerabilities of many older adults, including those in the 50–64 age group, and pursue strategies to connect them with services and supports that can help to address financial challenges and reduce the potential adverse effects on their health and well-being.

Data Source and Methods

This National Poll on Healthy Aging report presents findings from a national household survey conducted exclusively by NORC at the University of Chicago for the University of Michigan’s Institute for Healthcare Policy and Innovation. This survey module was administered online and by phone from February 22nd–March 12th, 2024 to a randomly selected, stratified group of U.S. adults age 50–101 (n=3,379), with an oversample of non-Hispanic Black and Hispanic populations. The survey completion rate was 44% among panel members invited to participate. The margin of error is +/- 1 to 4 percentage points for questions asked of the full sample and higher among subgroups.

Findings from the National Poll on Healthy Aging do not represent the opinions of the University of Michigan. The University of Michigan reserves all rights over this material.

Read other National Poll on Healthy Aging reports and about our Michigan findings, and learn about the poll methodology.

Citation

Kullgren J, Singer D, Solway E, Kirch M, Roberts S, Smith E, Strunk S, Levy H. Making Ends Meet: Financial Strain and Well-Being Among Older Adults. University of Michigan National Poll on Healthy Aging. July/August 2024. Available at https://dx.doi.org/10.7302/23532